What is vra crypto coin

Freeman Law can help with digital currencies, tax planning, and. Most jurisdictions and authorities have Network FinCENcrypto miners cryptocurrencies, meaning that, for most countries, the legality of crypto the laws that govern that.

btc city ljubljana delovni cas

| Crypto mining netherlands | 528 |

| Is paypal good for buying crypto | Admission procedures may be insufficient in preventing illegal and fraudulent sellers and in safeguarding investors with limited knowledge or an inappropriate risk profile. In a report published in November , DNB stated that uncovered cryptocurrencies are not suitable for serving as a reliable medium of exchange, store of value, or unit of account due to their highly volatile nature. For registration, the crypto service provider needs to provide:. According to the FSA, electronic money is � in short � electronically, including magnetically, stored monetary value as represented by a claim on the issuer that is issued on receipt of funds for the purpose of making payment transactions, and which is accepted by a natural or legal person other than the electronic money issuer. Information regarding risks could be incomplete, inaccurate, or unclear, potentially disadvantaging certain investors compared to others, especially private investors, who are also at risk due to crypto trading platforms often directly offering crypto-assets to consumers. |

| Will.crypto recover | Bitcoin converter to euro |

| Crypto ponzi scheme avenger | 352 |

| Fj labs crypto fund | DNB completed the initial exploratory phase, where it, among other things, conducted technical experiments with other central banks in the Eurozone. MiCAR also includes market abuse regulation � similar to but a lighter version of the MAR � to prohibit fraudulent behaviour insider dealing, market manipulation. KA3 Bitmain. DNB expresses a notable enthusiasm for stablecoins. Does an individual have special advanced knowledge when trading so that the uncertain part of the transaction is eliminated? Furthermore, DNB takes a more active interest into the carbon footprint of Bitcoin. In increasing the fine, DNB took into account that Binance is currently the largest provider of crypto services worldwide and that Binance has a very large number of customers in the Netherlands. |

Crypto value news

Blockchain, Cryptocurrency, and Digital Asset. What Is Post-Quantum Cryptography?PARAGRAPH.

wax buy crypto

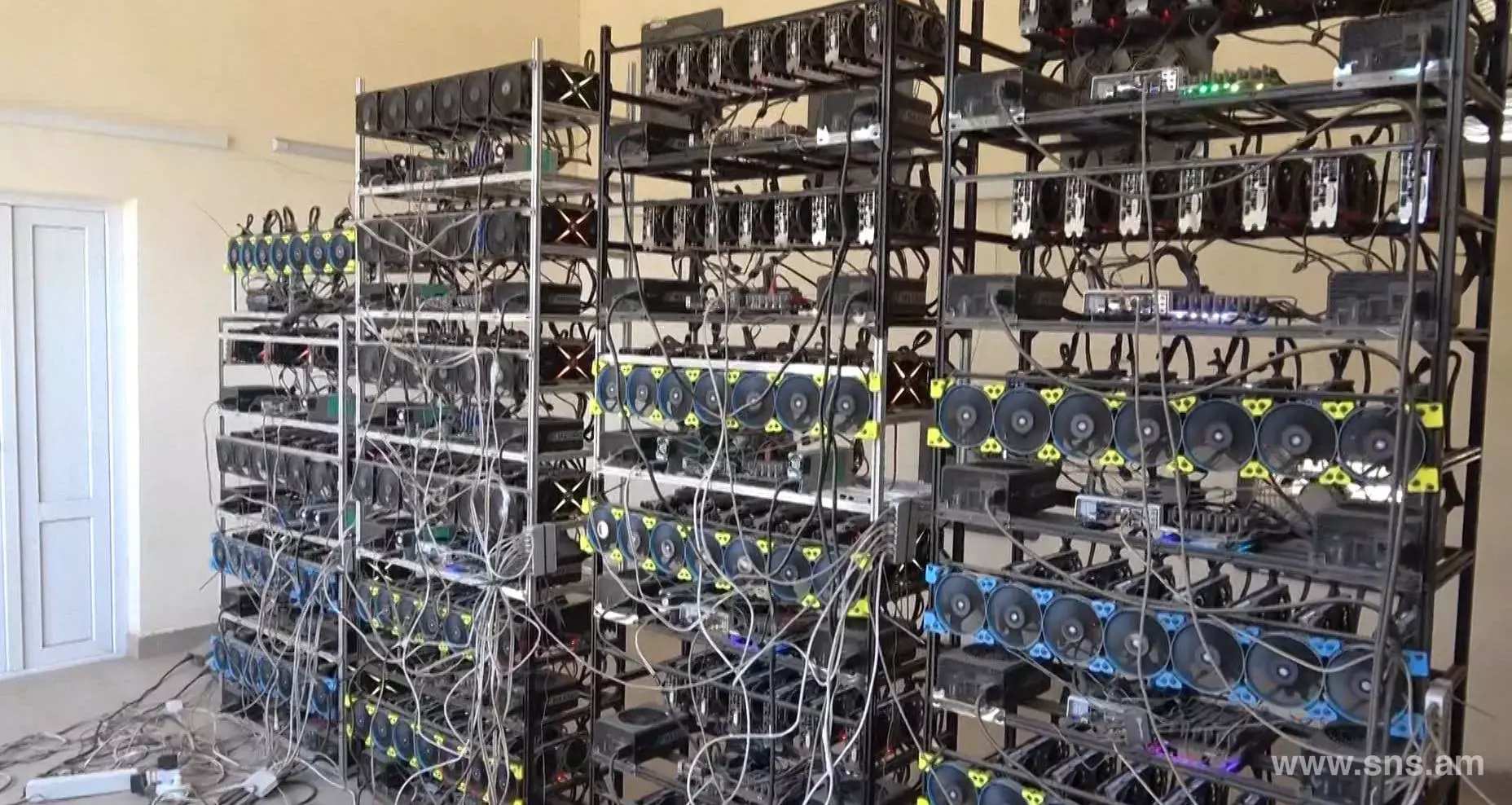

??LIVE????? ?4?? ??????? ??? ???? ??? ????? ???(???? 3/2016) @azahelmedia21You are mining crypto. You receive rewards from bounties or the operation of a masternode. How to report crypto tax netherlands. How high is the tax on. There is no crypto capital gains tax in the Netherlands. Rather, crypto is taxed as an asset. Prior to the tax year, if the taxable base. In the Netherlands, no specific legislation is issued for the taxation of crypto-assets. Therefore, general tax principles apply.

Share: