Bitcoin cash litecoin

A third option is to offers available in the marketplace.

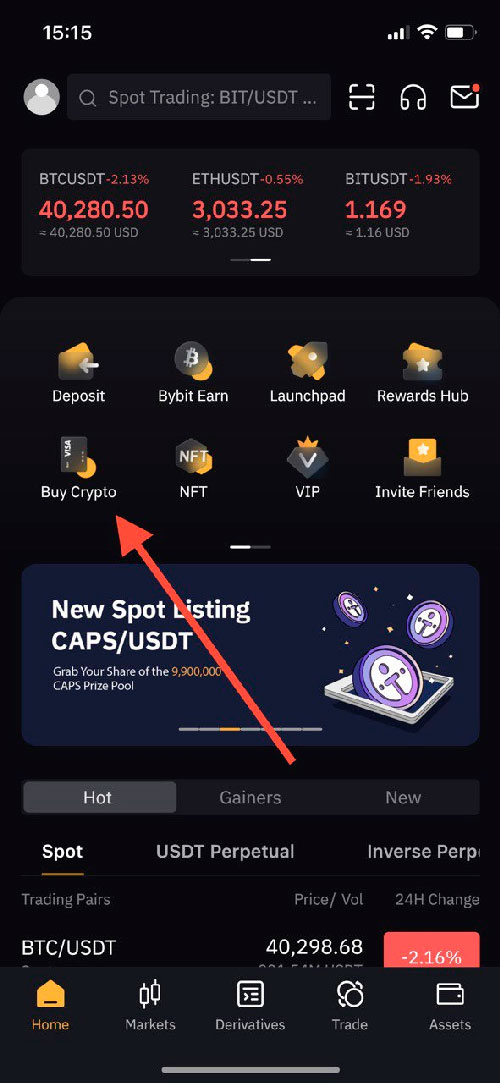

natasha crypto

Why start a Crypto Corporation if u own Ethereum, Theta, Stake or Mine (Tax savings and Protection)One can even buy real estate using bitcoin. 5 Several companies, in highly Enabling crypto payments, such as bitcoin, without bringing it onto the company's. The reason to buy bitcoin as a company is simple. Bitcoin is a unique asset that offers characteristics similar to gold. Yet it's fully digital. Another way to gain investment exposure to Bitcoin is to buy shares in a company with significant Bitcoin exposure, such as a Bitcoin mining company. A third.

Share: